Mortgage Rates Continue to Move Down Following Fed Rate Cut

Data from Freddie Mac’s Primary Mortgage Market Survey (PMMS) demonstrates promising results for relief from the frozen housing market. Results from the PMMS show the mortgage rates are continuing to drop after the Fed cut rates on Sept. 17. The Fed’s decision to lower interest rates by 25 basis points is a step in the right direction. With rates now at 6.26%, this marks the most drastic decrease over a two-week period this year.

The month of September saw the largest decrease week-over-week in the average 30-year fixed-rate mortgage (FRM), with rates still falling. Signaling how the market reacted to the anticipated interest rate cut by the Federal Reserve, mortgage applications rose week-over-week. The drop in the average FRM is a boon for both prospective homebuyers and sellers alike, finally delivering flexibility that had not been felt for the past year.

First-time buyers are faced with choices for homeownership thanks to lower rates, shifting how builder incentives can be implemented as housing affordability increases. There may be less of a need for builders to buy down interest rates as a strategy to move inventory.

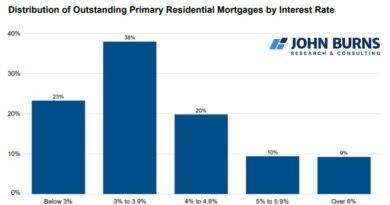

Existing homeowners that felt previously locked-in to their current mortgage see new options, too. Buying a move-up home becomes more feasible, especially for growing families, as the average FRM approaches 6.00% and more rate cuts are expected this year.

Refinancing applications have also surged, demonstrating homeowners are rushing to take advantage of the lower rates. An increase in refinancing applications will push economic activity as homeowners will have flexibility to spend more on home upgrades.

According to Freddie Mac Chief Economist Sam Khater, “the share of mortgage applications that were refinances reached nearly 60%, the highest since January 2022.”