Buyers Wait For Lower Rates and Economic Clarity

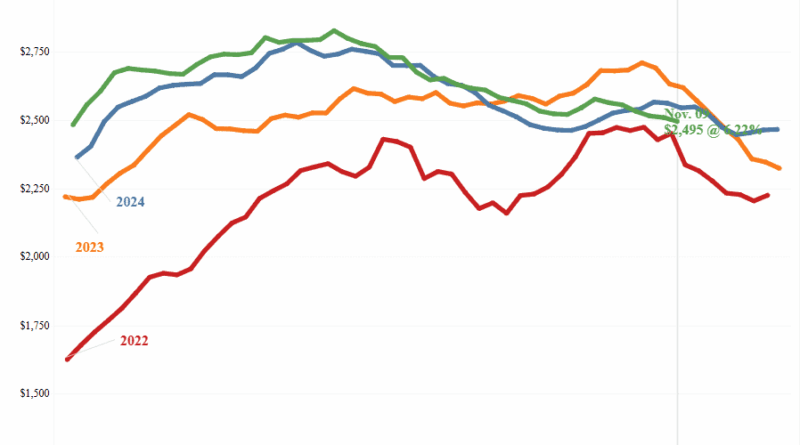

The U.S. housing market has slowed as buyers hesitate amid high prices, mortgage rates and economic uncertainty. Pending home sales fell 0.3% year over year for the four weeks ending Nov. 9, the first decline in four months, and homes are now taking a median of 49 days to sell, the longest since 2019. With mortgage rates hovering around 6.22% and home prices up 2.4%, many potential buyers are delaying purchases or waiting for rates to dip below 6% before reentering the market. A Redfin survey found that over one-third of Americans have delayed or canceled major purchases due to economic instability.

On the supply side, sellers are faring slightly better, with new listings up 3.4% year over year and active listings up 6.3%. Agents are advising sellers to price homes realistically, as buyers remain sensitive to affordability. While housing demand indicators, like Google searches and tour activity, show early signs of renewed interest, the market remains balanced but cautious. Experts warn that waiting for major rate or price drops could backfire, as lower rates might spark new bidding wars, while price declines could signal broader economic weakness.