10 housing predictions that came true

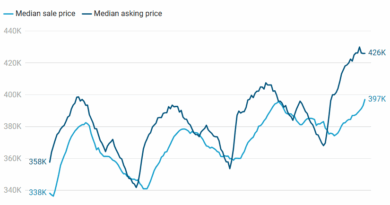

In 2024 and 2025, experts’ housing market predictions largely proved accurate. Mortgage rates stabilized near 6%, giving buyers and sellers more confidence despite not dropping dramatically. Housing inventory rose as homeowners with low-rate mortgages felt safer selling, increasing available homes by up to 33% year-over-year in some states. First-time buyers continued to struggle with affordability, with their market share hitting a record low of 21%, while all-cash buyers dominated among repeat buyers, relying on accumulated wealth or family assistance. Home prices grew modestly, around 2.1%, reflecting a balance between elevated rates and tight supply.

Construction forecasts also held. Single-family home starts grew steadily, with builders capturing more market share through incentives, while multifamily construction remained subdued due to prior oversupply. Demographic shifts aligned with predictions: older buyers and single women represented a larger portion of the market, while households with children declined. Refinancing stayed near historic lows as most homeowners remained locked into low-rate mortgages, reinforcing the inventory and affordability dynamics that shaped the market. Overall, expert forecasts captured key trends in pricing, construction, demographics and market behavior.