Adjustable-Rate Mortgage Applications Rise

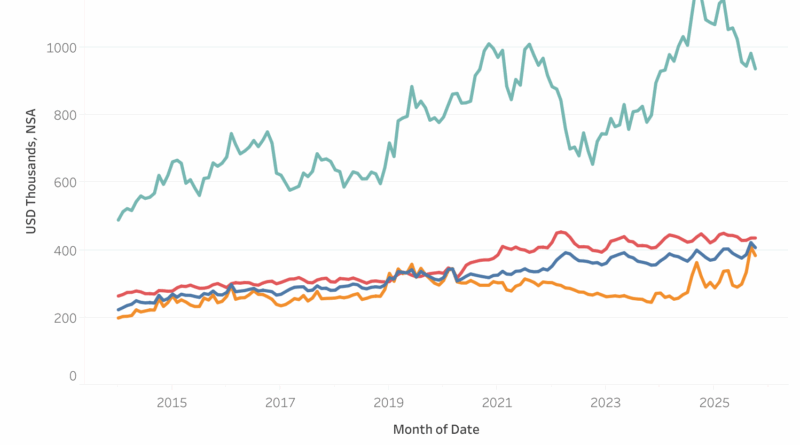

Mortgage activity rose sharply in October compared to last year as easing interest rates helped boost demand across the board. Even though total applications dipped month-over-month, they were up 39% from a year ago, with refinancing applications increasing 63% annually and purchase applications rising 18%. The average 30-year fixed rate fell to 6.37%, its lowest level in over a year, contributing to stronger year-over-year activity despite short-term declines.

Adjustable-rate mortgages (ARMs) saw the most dramatic growth, with applications more than doubling from last year and reaching one of their highest market shares in three years. While average loan sizes decreased overall, purchase loan sizes held steady and ARM loan sizes, still much higher than fixed-rate loans, fell 5%. The trends suggest consumers are responding to lower rates and exploring more flexible financing options as the mortgage market continues to stabilize.