More Home Sellers Test the Market, But Buyers Aren’t Budging

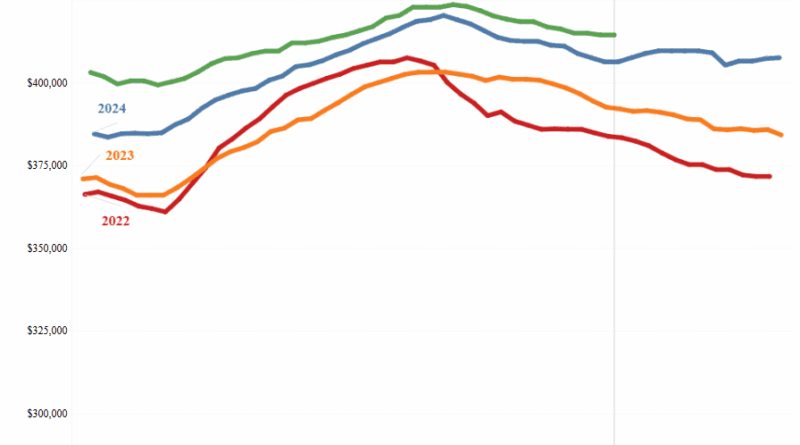

Pending home sales are slipping as cautious buyers hold out for deeper mortgage rate cuts or greater economic stability. Even as new listings climbed 2.3% year over year—the largest increase in more than three months—buyer activity failed to follow suit. Pending sales fell 1.3% annually, the steepest decline in five months, and homes are lingering on the market for an average of 48 days, the longest September stretch since 2019. Although the average 30-year mortgage rate recently hit a 10-month low of 6.26%, it has since inched up to 6.34%, still far above the pandemic-era lows that fueled the last housing boom. Coupled with a 2.1% annual rise in home prices, these elevated borrowing costs are sidelining many would-be buyers.

Economic uncertainty is also weighing heavily on consumer confidence, with factors such as weak job reports and concerns about a potential government shutdown making some Americans hesitant to make large purchases. However, those still in the market are finding opportunity in the slowdown. Buyers today have more leverage to negotiate price reductions, request concessions and secure favorable terms, especially for condos, where inventory far outpaces demand. In areas with abundant new construction, some builders are even offering mortgage-rate buy-downs and other incentives to attract buyers. Overall, while lower rates have prompted more sellers to list, buyer hesitation continues to restrain sales activity, signaling a cautious and uneven path forward for the housing market.