Mortgage Rates Tumble in Early September

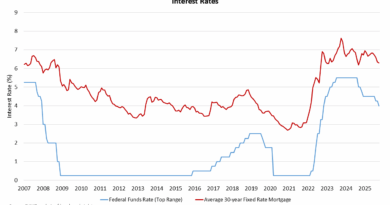

Results from Freddie Mac’s Primary Mortgage Market Survey show the 30-year fixed-rate mortgage averaged 6.50% as of Sept. 4, 2025. This is down from last week’s average of 6.56%, which can be seen here. As the mid-September Federal Reserve Meeting is expected to cut mortgage rates, the anticipated 6.50% rate came earlier than predicted.

Originally, mortgage rates were expected to reach the current rate by the end of the year, and drop to 6.00% by the end of 2026. As the Fed is forecasted to cut rates in the next meeting, the average has already begun dropping. Survey results from a year ago at this time show rates at 6.35%, demonstrating rates inch closer to year-over-year stability.

A drop in mortgage rates is poised to alleviate the frozen housing market, prompting prospective homebuyers to seize lower rates. Sellers who feel “locked in” to their current low mortgages may feel greater flexibility to buy a new home soon.

According to Sam Khater, Freddie Mac’s Chief Economist, “Mortgage rates continue to trend down, increasing optimism for new buyers and current owners alike.”