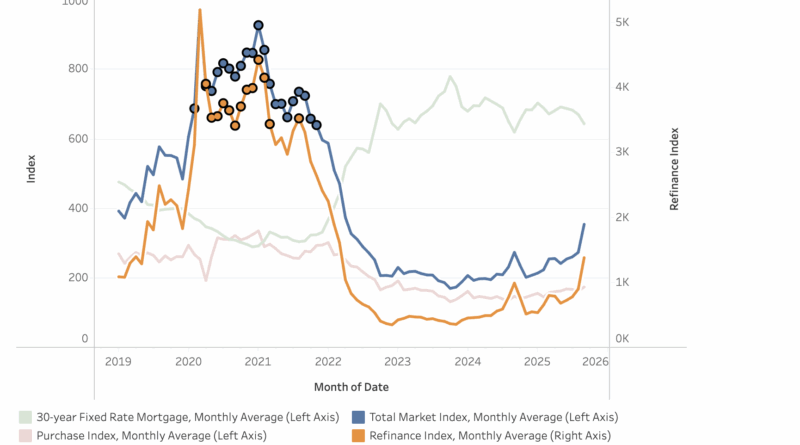

Refinancing Activity Surges in September

Refinancing activity surged in September as mortgage rates dipped below 6.5% for the first time since October 2024, sparking the largest monthly increase in mortgage activity since the early pandemic years. The Mortgage Bankers Association’s Market Composite Index, which tracks total mortgage applications, rose 29.7% from August and nearly 30% year-over-year. With the average 30-year fixed mortgage rate falling 27 basis points to 6.42%, homeowners rushed to take advantage of the lower borrowing costs. Refinancing applications jumped 54.2%, while purchase applications climbed 7.7%, marking a broad-based rebound in housing market activity.

The drop in rates not only spurred more applications but also pushed loan sizes higher. The average refinance loan amount jumped 22.3% to $410,000—the largest monthly increase since records began in 2011—as higher-balance borrowers moved quickly to lock in savings. Purchase loans also rose modestly to $436,000, while adjustable-rate mortgage loans averaged $984,000. Overall, the average loan size across all types grew 9.2% to $423,000, underscoring renewed momentum in both refinancing and purchase activity amid easing financial conditions.