Single-Family Construction Loan Volume Falls Back

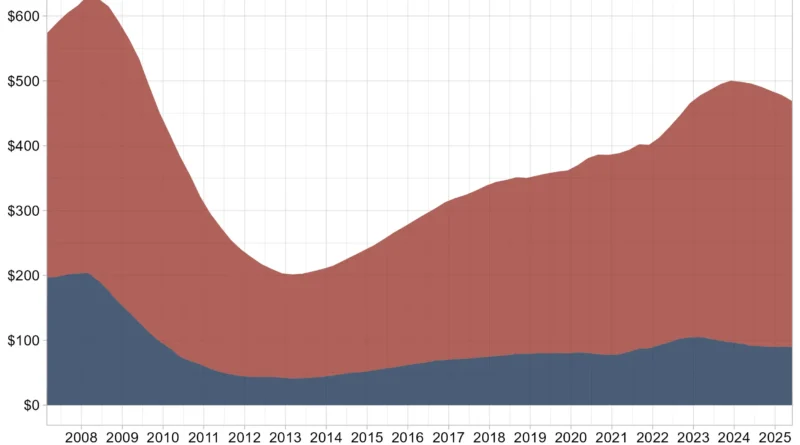

In the second quarter of 2025, builders continued to face tighter credit conditions as reported by the NAHB Land Acquisition, Development and Construction (AD&C) loan survey, with FDIC data showing a continued decline in outstanding loan volumes. The total stock of AD&C loans fell for the sixth consecutive quarter, dropping to $469.1 billion, down 5.3% from a year earlier. This decline was driven primarily by a decrease in other real estate development loans, which fell to $379.3 billion. Loans for 1-4 family residential construction and land development also declined slightly to $89.8 billion, down 2% annually and 0.3% from the prior quarter.

Although FDIC data only track the stock of loans and not lending flows, they highlight how far residential construction lending has fallen compared to historical peaks, 56% below the $204 billion peak in 2008. To fill this gap, many builders have increasingly turned to alternative financing sources such as equity partners. On the positive side, loan quality improved, as the share of 1-4 family construction loans that were past due or in non-accrual status fell to $1.1 billion, or 1.2% of total volume. Non-accrual loans accounted for $572.1 million, while loans 30–89 days past due totaled $469.2 million, reflecting slightly healthier loan performance despite the overall pullback in credit availability.