U.S. home price insights — October 2025

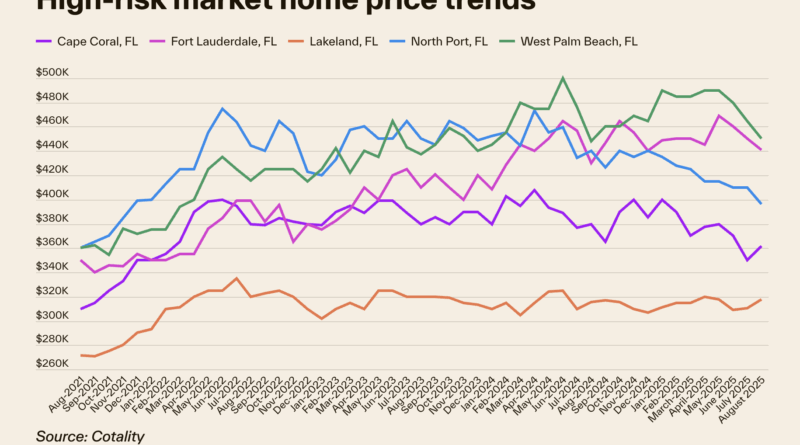

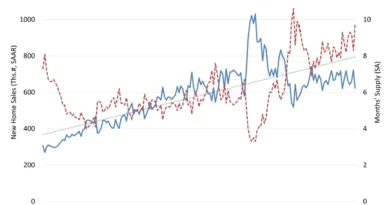

The U.S. housing market remains in a gradual rebalancing phase, with home sales activity hovering near multi-decade lows due to persistent high mortgage rates and limited inventory. Price growth in August was modest, up just 1.3% year over year, lagging behind overall inflation at 2.9%. However, the picture varies widely by region. Northeastern states continue to post strong housing fundamentals, with home prices rising 6–7% annually, while many markets in the South and West, including Florida, Texas, California and Arizona, are experiencing price declines. These weaker regions are also burdened by higher escrow costs driven by rising property taxes and insurance rates, which have climbed an average of 45% over the past five years.

These escalating costs are straining affordability and slowing market activity, leading to longer listing times and more difficult closings even as for-sale inventory grows. The median U.S. home price recently dipped slightly to $400,000, reflecting slower appreciation and growing price pressure in costlier markets. Still, there is a silver lining—lower prices and a recent dip in mortgage rates have modestly improved affordability to its best level since 2022. While the market remains fragmented, these shifts suggest a slow return toward balance as buyers and sellers adjust to new financial realities.

“Enhanced affordability has provided much-needed relief to the housing market, which has experienced limited momentum over the past two years,” said Cotality Chief Economist Dr. Selma Hepp.