NAHB Insight: The Fed cuts

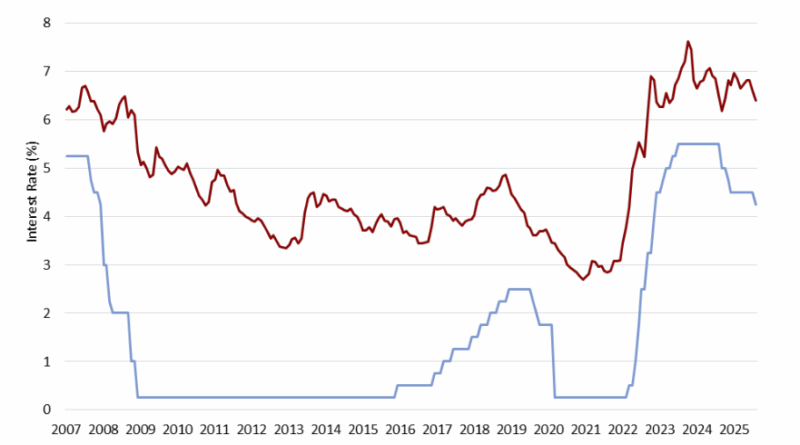

Dr. Robert Dietz, chief economist and senior vice president for economics and housing policy for NAHB, gives his insight on the latest Fed cuts and what it means for homebuilders. Following their September meeting, The Federal Reserve’s monetary policy committee (FOMC) voted to reduce the short-term federal funds rate by 25 basis points. This decision decreased the target federal funds rate to an upper rate of 4.25%.

Economists at NAHB predict the coming quarters will see another 75 basis points of easing, with 25 of that total coming before the end of the calendar year.

In the Fed’s FOMC statement they stated, “In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals. The Committee’s assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.”

Homebuilders and the housing market were anticipating this FOMC policy decision. The result of the federal funds rate will have a direct, positive effect on interest rates for acquisition, development and construction loans and reduce lending costs for builders nationwide. This will likely instill a stronger rate of builder confidence in the coming months.

“Overall, today’s decision was widely expected. Much of the benefit of today’s easing was already priced into long-term interest rates, but the rate cut will benefit business loan finance conditions. Further, additional rate cuts lie ahead, although as Chair Powell noted, “policy is not on a pre-set course.” Future Fed actions will depend on incoming data and the evolving policy environment,” stated Dr. Dietz