2026 Outlook: Finding a Steady Ground

The housing market enters 2026 still shaped by crosscurrents, range-bound mortgage rates, uneven demand and patchy increases in resale inventory. Rather than signaling a dramatic turning point, these dynamics point toward a year defined by the search for stability. For builders, who adjust production based on real-time demand, that pursuit will guide strategy, pricing and the cadence of construction.

Even in a cooler housing environment, new construction retains meaningful advantages rooted in long-running fundamentals. Years of underbuilding relative to household growth left the U.S. with a sizable housing deficit. That shortfall continues to support demand, especially as many existing homeowners remain locked into ultra-low mortgage rates and are reluctant to list. Outside of a handful of supply-rich markets, resale inventory nationally remains below historical norms.

Builders also offer something the resale market cannot: flexibility. Incentives, such as rate buydowns, can make monthly payments materially more affordable than headline mortgage rates imply. In an affordability-strained environment, that ability to “manufacture” affordability is a clear competitive advantage. Add to that the predictability of newly built homes, energy efficiency, warranty coverage, fewer near-term repairs and new construction continues to appeal to cautious buyers navigating uncertainty. Taken together, these factors suggest that the new-home segment will likely continue to outperform the existing-home market on a relative basis in 2026.

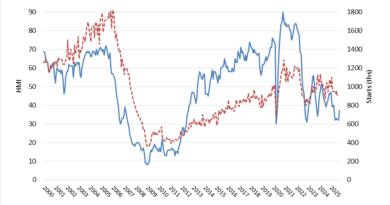

However, the positive structural backdrop does not erase the near-term challenges. Single-family construction trended lower through 2025 as builders focused on selling off elevated inventories. Months’ supply of new homes remains elevated, reinforcing a “sell what is built first” mindset among builders. Production is unlikely to increase meaningfully until demand shows sustained strength rather than intermittent bursts.

Affordability remains the central friction. Mortgage rates in the low-6 percent range are an improvement, but the relief is modest against the backdrop of elevated home prices and years of rising financing costs. Many prospective buyers still face payments well above comfort levels, keeping demand sensitive and reactive. Resale inventory has risen in some metros, giving price-conscious buyers more alternatives to new homes. Add in a softening, but still uncertain labor market, shifting inflation expectations and weak consumer sentiment and many households remain hesitant to move unless compelled.

Supply-side cost challenges also continue to shape builder behavior. While material price growth has moderated from pandemic-era peaks, prices remain structurally higher and labor shortages persist in many markets. These factors raise the cost baseline for delivering a new home and make builders cautious about starting construction without clear visibility into future demand. Incentives help bridge affordability gaps, but weigh on margins, reinforcing a disciplined approach to starts.

The most realistic outlook for 2026 is a steady, unspectacular market. Lower and less volatile rates should help restore confidence for buyers and builders alike. Rate stability matters almost as much as the rate level itself. When contract-to-closing risk diminishes, buyers feel more secure committing.

Mix will also shape the year ahead. Builders are leaning more heavily into smaller homes to meet affordability constraints, a shift that aligns with the financial realities of today’s buyers. Resale competition will remain highly localized, with markets benefiting from sustained in-migration or strong job bases stabilizing sooner than those grappling with elevated insurance costs or weaker economic fundamentals.

Ultimately, 2026 is unlikely to deliver a sharp rebound in sales or construction, but neither is it poised for a decline. Instead, the market is moving slowly toward steady ground, one where demand and supply come back into balance, incentives moderate as affordability improves and builders gain clearer visibility into the cycle’s next phase. That gradual return to stability is an essential foundation for the housing recovery ahead.

Odeta Kushi is the deputy chief economist at First American. She may be reached at mginnaty@firstam.com

This column also appears in the January issue of Builder and Developer, read the print version here.