Fed pauses easing cycle

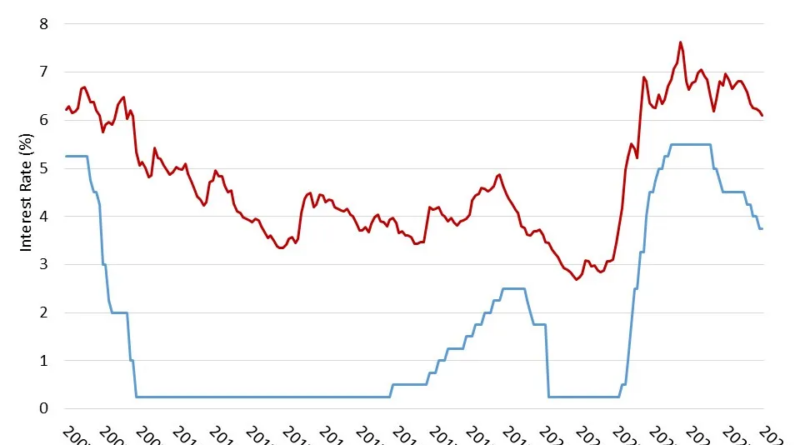

The Fed at their January meeting of the Federal Open Market Committee decided not to continue easing interest rates. This holds the short-term federal funds rate at a top rate of 3.75% which was set in December. This is the first time since September that the Fed has not eased rates.

Their FOMC statement read. “Available indicators suggest that economic activity has been expanding at a solid pace. Job gains have remained low, and the unemployment rate has shown some signs of stabilization. Inflation remains somewhat elevated.”

NAHB economists predict two more rate cuts in 2026.

“While reductions for the federal funds rate do not have a direct effect on mortgage interest rates, which remain slightly above 6%, federal funds rate reductions do lower interest rates on builder and developer loans, helping the supply-side of the housing market,” said NAHB Chief Economist Robert Dietz. “Supplying more housing and at lower cost is key to solving the ongoing housing affordability challenge. Lower financing costs are part of the overall solution.”