Homeownership rate inches up

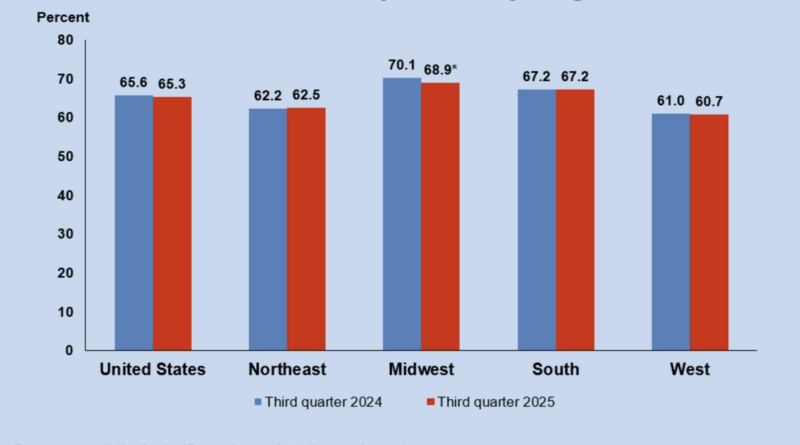

According to the Census’s Housing Vacancy Survey (HVS) of Q3 2025, the latest homeownership rate rose up to 65.3%. However this rate is not an anomaly from the third quarter 2024 rate (65.6 percent) nor the rate in the second quarter 2025 (65.0 percent).

While this is a step in the right direction, there are still some signs that affordability issues persist. The homeowner vacancy rate of 1.2 percent was higher than the rate in the third quarter 2024 (1.0 percent) and higher than the rate in the second quarter 2025 (1.1 percent). Additionally, in the third quarter 2025, the median asking rent for vacant for rent units was $1,534. This rate of 65.3% is still significantly below the peak of 69.2% in 2004. Currently, it remains below the 25-year average rate of 66.3%.

Compared to the previous year, homeownership rates increased in three age groups while decreasing in two. Homeownership for those under 35 saw a .5% uptick to 37.5%. This age group is particularly sensitive to the renting and entry level-market. With inventory and affordability concerns persisting throughout 2025, while not a sign of a complete market turnaround it exhibits some success. The 45-54 age range saw less of an increase at .3% but puts them at a strong 70%. Homeownership rates for the ranges 35-44 and 65 years and over each declined 1.2 percentage points from a year ago.

“The housing stock-based HVS revealed that the number of total households increased to 133.1 million in the third quarter of 2025 from 132.0 million a year ago,” said Na Zhao, Ph.D., Principal Economist at NAHB. “This increase was driven by both owner and renter household growth.”

The fourth quarter 2025 data from the Census is scheduled for release on February 3, 2026.