Lower Mortgage Rates Trim Hundreds Off Monthly Payments

Pending home sales in the U.S. ticked up just 1% from last year, showing that many buyers remain cautious even as mortgage rates decline. The daily average mortgage rate recently fell to 6.28%, its lowest level in nearly a year, boosting buyers’ purchasing power by more than $20,000 since the summer. This drop has pushed the typical monthly mortgage payment down to about $2,600—over $200 less than the peak earlier in 2025. Still, rising home prices are limiting affordability, with the median sale price reaching nearly $393,000 in early September, up 1.7% year over year. Redfin agents report that while some buyers are reentering the market, many remain on the sidelines, hoping rates will fall further after the Federal Reserve’s September meeting.

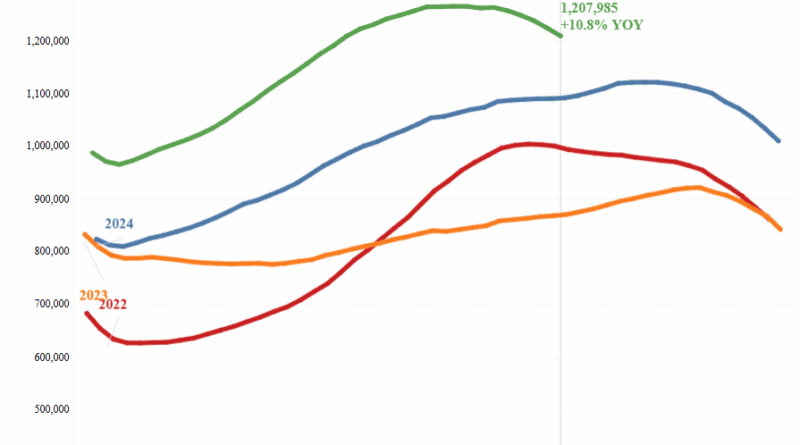

On the supply side, new listings remain sluggish, increasing only 1.3% year over year compared to double-digit growth earlier this spring. Active listings rose just under 11%, marking the slowest pace since early 2024, while homes are sitting on the market longer and selling less frequently above list price. At the metro level, markets like Pittsburgh, Detroit and New Brunswick, N.J., are seeing some of the fastest price and sales growth, while cities such as Houston, Las Vegas, and Denver report notable declines. Overall, softer demand, elevated prices and limited new listings are keeping the housing market in a state of cautious balance despite the relief of lower mortgage rates.