Monthly Housing Payment Posts Biggest Decline in Nearly a Year

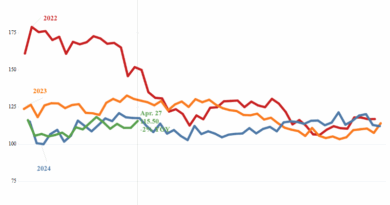

The U.S. housing market is showing early signs of movement as falling mortgage rates encourage some hesitant buyers to return, even as prices continue to climb. For the four weeks ending October 26, the median monthly housing payment dropped 1.4% year over year to $2,530 — the largest decline since late 2024. This decrease is mainly due to mortgage rates falling to 6.19%, their lowest level in over a year, following a cooler inflation report and a Federal Reserve rate cut. However, home prices still rose 1.9% annually, suggesting affordability remains a challenge. Redfin economists caution that further rate declines are unlikely in the short term, especially after the Fed hinted it may pause additional cuts in December.

Buyer activity remains subdued but is beginning to improve, with pending home sales up 1% from last year and mortgage-purchase applications rising 5% week over week. Some buyers are waiting for rates to fall below 6%, while others remain wary of economic uncertainty. On the selling side, new listings are up 4.6%, the largest gain in five months, as homeowners try to capitalize on the recent dip in borrowing costs. Redfin agents advise sellers to price homes realistically and stay flexible in negotiations, noting that buyers currently have the upper hand in many markets. With more inventory and cautious demand, the market appears to be slowly rebalancing after two years of volatility.