No Risk-Free Path, Fed Eases Monetary Policy

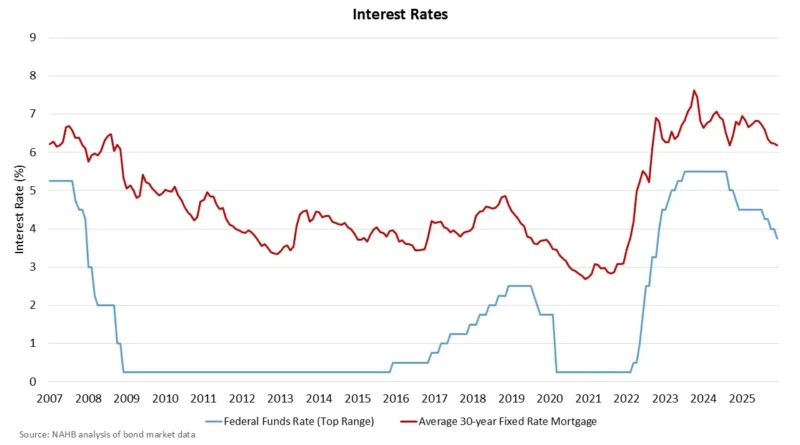

The Federal Reserve delivered its third and final rate cut of 2025, lowering the federal funds target range by 25 basis points to 3.5%–3.75%, a move expected to ease financing costs for builders and developers. Separately from monetary policy, the Fed also announced it will begin purchasing short-term Treasury securities on December 12 to maintain adequate reserves and support market functioning.

Fed officials acknowledged that job gains have slowed, unemployment has edged higher, immigration has declined and hiring has cooled, conditions blurred somewhat by delayed data following the government shutdown. Chair Powell emphasized ongoing housing weakness, low supply and the lock-in effect from low mortgage rates, noting the nation hasn’t built enough homes to meet demand. Inflation has eased but remains elevated, leading the Fed to frame this cut as insurance against weakening growth rather than a response to reaccelerating inflation. Looking ahead, the Fed’s economic projections show stronger GDP growth in 2026, rising unemployment to 4.4% and inflation not returning to 2% until 2028. The outlook suggests one rate cut in 2026 and another in 2027, though the dot plot shows wide disagreement, highlighted by one projection for five cuts, and future policy is clouded by a new Fed Chair taking office in May 2026.