Recalibration of the Land and Housing Market

The U.S. land and housing market is evolving through a period of recalibration, marked by slower population growth, shifting capital strategies and renewed optimism as costs stabilize and interest rates ease. The outlook for 2026 positions the industry for a measured but meaningful recovery, supported by improved efficiency and a more balanced relationship between builders, developers and investors.

After decades of expansion, population growth is moderating. Both immigration and natural growth have slowed, leading to the lowest overall gains in decades. Yet domestic migration continues to benefit many growth markets, particularly in the Sunbelt and Mountain West, where affordability and lifestyle remain powerful draws. These inward flows sustain demand, even as overall absorption rates have softened from their pandemic-era peaks.

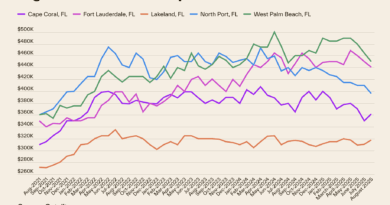

Home prices and rents, after years of escalation, have plateaued and even declined in select regions. This moderation, while challenging for margins, is reintroducing equilibrium. Wage growth has outpaced inflation in many markets, which means buyers are again able to qualify for mortgages and manage housing costs as a smaller share of income. The combination of stable prices and stronger earnings sets the stage for increased attainability, an overdue correction welcomed by both policymakers and the public.

Another underappreciated tailwind is the easing of land-use regulations in many jurisdictions. Facing chronic housing shortages, municipalities are increasingly mandating approvals for residential projects on former commercial land. These shifts, though uneven nationally, mark a clear movement toward flexibility that expands supply opportunities. Some states are pairing zoning reform with infrastructure incentives, helping expedite new development where it’s most needed.

Public and private builders alike have embraced a “land-lite” model. Controlling rather than owning land outright has become the norm. This allows builders to preserve liquidity and maintain stronger returns on equity. The counterweight is several hundred basis points of reduction in gross margin as builders forgo land appreciation gains while deploying significantly less capital per project. The largest example is Lennar’s strategy with the Milrose REIT, which made the first large leap from the institutionalization to securitization of a lot banking vehicle. In the past 24 months, several public builders who had previously rejected lot banking have now embraced it.

Lot bankers, meanwhile, are showing resilience and patience. While some takedowns fall out of schedule, very few lot banks have defaulted. With current interest payments continuing, most lot banks have retained negotiated yields. This discipline on both the builder and lender sides has prevented distress sales and underscored the industry’s maturity compared to previous cycles. As one major lot banker put it: “lot banking has demonstrated it is a durable asset class.”

Construction costs from 2020-2023 were an inflationary runaway train, but have now eased to see vertical costs down roughly 5-10%, and horizontal development costs have stabilized. The bidding environment is more competitive, labor availability has improved, and construction cycle times are nearly back to pre-covid levels. These factors enhance project viability and project returns.

Equally encouraging is the recent decline in interest rates, a broad relief that extends beyond mortgages to builder bonds and private lender borrowing. Lower rates also compress cap rates, benefiting the build-to-rent and multifamily sectors, both existing and planned. Animal spirits are beginning to stir as developers who paused on projects during the rate spike are now revisiting them with confidence that over-supplied markets will see shortages as current inventory is absorbed. The window that was shut has cracked open, and soon a new build bell will ring.

Investment in construction and housing technology, while promising, has sobered. Many early ventures failed to achieve scale, leaving significant capital losses and a more cautious funding environment. Yet, this prudence is reshaping innovation toward practical applications: modular builds, AI-driven design tools and precision project management. While the “moonshot” phase may be cooling, technology continues to yield quiet but important efficiency gains.

The land business enters 2026 with a foundation of balance and opportunity. The extreme cycles of shortage and surge are giving way to a more sustainable cadence, where disciplined builders, patient capital and adaptive local policy drive progress. As population growth stabilizes, costs normalize and capital costs are reduced, the industry is poised not for a boom but for steady, durable expansion, a welcome rhythm for the entire industry.

Greg Vogel is Founder and CEO of Land Advisors Organization. He may be contacted at gvogel@landadvisors.com

This column was featured in our December issue of Builder and Developer, read more here