The Outlook for Mortgage Finance

Rising debt levels and recent tax policy changes are shaping the U.S. economic outlook in the post-pandemic era.

Around the world, governments are borrowing more money as pandemic related bills are coming due and the population is aging. Debt/GDP levels are rising and investors are pushing up term premiums in response, requiring a higher return to bear the risk of growing fiscal pressures.

The U.S. is struggling with fiscal pressures as well. After the pandemic, the U.S. debt/GDP was at 100%, approaching the historical peak reached during World War II. Annual deficit/GDP ratios of six percent have only been surpassed by peaks during the Civil War and World War II.

In President Trump’s first term, he passed a substantial rewrite of the U.S. tax code which resulted in lower marginal rates for corporations and households, while removing or reducing some deductions and exemptions. The onset of the pandemic muddied the waters quite a bit regarding the net impact of the 2017 tax bill (The Tax Cuts and Jobs Act, “TCJA”). However, one feature of the bill was that while the cut in corporate tax rates was permanent, the reduction in individual tax rates would last only until the end of 2025. The sharp increase in tax rates could have caused an equally sharp slowdown in the economy in 2026. However, while there was some drama regarding the passage of the 2025 tax bill (the “One big beautiful bill”), which extended the lower individual rates, it was passed and signed by the President in July.

Growing deficits and debt will put upward pressure on longer-term U.S. rates over the medium to longer-term. In the near term, the direction of interest rates will certainly be impacted by the business cycle.

Inflation reached 40-year highs in 2022, as a combination of pandemic-related supply chain pressures and overly stimulative fiscal and monetary policies led to price pressures. The Fed responded with a rapid, five and a half percentage point increase in short-term rates. In 2024, as inflation was dropping back towards the Fed’s two percent target, the Fed cut rates by one percentage point, which have remained the same as of today.

Given the fiscal pressures outlined above, any drop in short-term rates is not likely to lead to as large a decrease in longer-term rates. Our forecast is for the ten year treasury yield to remain roughly stable, on average, over the next couple of years, with downward pressure from the softer economy offset by upward pressure from the fiscal situation.

Housing and Mortgage Market Trends

Builders have responded to a lack of inventory of existing homes, due to the “lock-in” effect, the tendency of homeowners with extremely low mortgage rates to be hesitant to list their homes for sale. This lack of existing inventory enabled home prices to keep rising even as mortgage rates shot up. However, in 2025, the situation has changed. Although mortgage rates remain in the 6.5% range, the lock-in effect appears to be easing. The number of existing homes on the market is up about 30% compared to last year.

This change in the balance between supply and demand is leading to a fundamental shift in the outlook for home price growth. After increasing four percent nationally in 2024, we are forecasting growth of only one percent this year, and flat home prices over the next two years.

The U.S. mortgage market is always subject to wide swings in origination volume. When mortgage rates decline, more homeowners look to refinance to save money on their monthly payments. The extremely low mortgage rates in 2020 and 2021 led to a monster refinance wave, with origination volume reaching almost $4.5 trillion, as millions of homeowners successfully locked in lower rates. And those who bought homes utilizing these low rates also brought purchase volumes up to quite high levels.

The refinance wave came to a sudden halt in the second half of 2022 as mortgage rates soared. Higher mortgage rates and low housing inventory slowed purchase volume, even though potential borrowers were in good shape, with the unemployment rate reaching 3.4%, its lowest level since 1968.

2024 was a marginally better year in terms of mortgage originations, and 2025 is looking to show similarly modest gains. However, the elevated level of policy uncertainty and financial market volatility have certainly caused many potential borrowers to pause. Our expectation is that mortgage origination volume will grow by about 11% in 2026 and then another two percent in 2027.

Home Equity Lending

According to the recently completed 2025 Home Equity Lending Study, the total originations of open-end home equity lines of credit (HELOCs) and closed-end home equity loans increased in 2024 by 7.2% from the previous year when comparing originators that reported in both years. Total HELOC and home equity loan debt outstanding grew 10.3%.

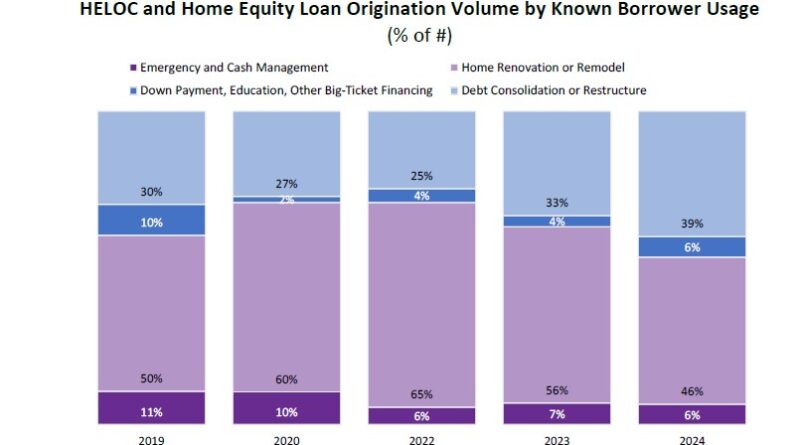

The Federal Reserve states that there is close to $35 trillion of homeowner equity in residential real estate. In 2024, approximately 39% of borrowers cited debt consolidation as the reason for applying for a HELOC or home equity loan, compared to 25% two years prior. Those borrowers who indicated home renovations as their reason for usage dropped to 46% of volume, compared to 6% in 2022. The remaining borrowers indicated emergency/cash management or big-ticket financing, such as for education or a down payment (bridge loan alternative, second homes and investment homes).

Homeowners who purchased properties and benefitted from the run-up in values during the pandemic may well be looking to finance energy efficient improvements, solar panels or other features given this stock of wealth. On the other hand, homebuyers today, who are seeing a much slower pace of home price growth for the next several years, may not have access to the same growing equity as current homeowners.

By Michael Fratantoni, Chief Economist and Senior Vice President of Research and Business Development at Mortgage Bankers Association. He may be reached at MFratantoni@mba.org

This article appeared in our September issue of Builder and Developer,