The Rise of Well-Capitalized Homebuilders

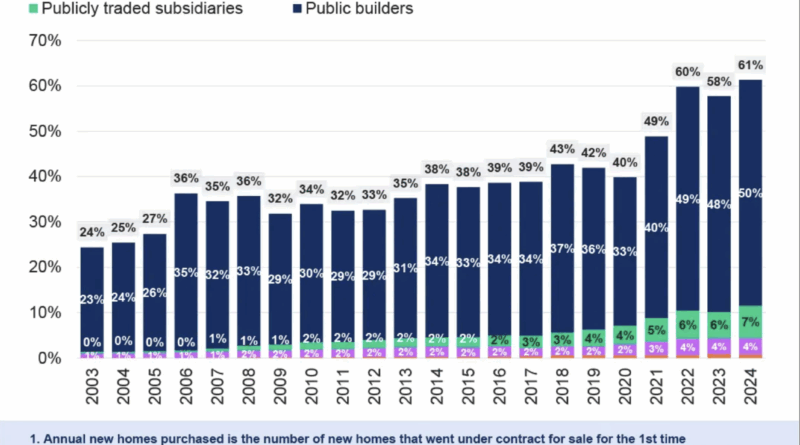

In the past few decades the homebuilding and construction industry has greatly changed, notably the rise of well-capitalized homebuilders. Jody Kahn, Senior Vice President of Research at John Burns Research and Consulting, gives her insight on how these homebuilders shifted the industry to be more resilient and with less debt. She cites that 61% of new homes in America are now built by companies with professional and well supported ownership structures. This includes the 50% of builders are a publicly traded equity. Following almost half the market are subsidiaries of large American or Japanese publicly traded conglomerates which make up 7% of market share, privately owned companies with publicly traded debt around 4% of market share and well-capitalized regional private builders about 1% market share.

She continues that large builders have accounted for more than 58% of all US home sales since 2022. They yield the resources to persist through a softer market and less debt to carry.

“The growing pool of well-financed public and private homebuilders will likely capture a rising share of US home sales going forward,” said Kahn. “Smaller local builders often struggle during periods of low demand, while larger, capital-backed homebuilders are better positioned to keep building, capitalize on growth cycles and potentially stabilize the new home sector.”

This in no means should discourage smaller builders. Kahn urges the importance of a niche focus to stay competitive.