U.S. Cities Investing in More Affordable Housing

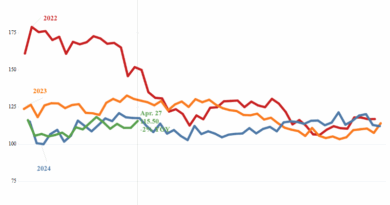

Housing affordability remains one of the most pressing challenges in the U.S. housing market as home prices continue to climb despite slowing growth. The national median home price reached nearly $374,000 in June 2025, more than double the 2012 low, while wages have lagged far behind. Rising mortgage rates have further compounded the issue, driving monthly payments up nearly 60% in just three years and pushing homeownership further out of reach for middle-income families. Even with modest gains in inventory, buyers earning around $75,000 annually can only afford a fraction of available listings, highlighting the persistent shortage of attainable homes.

Meanwhile, residential construction activity is slowing at a time when additional supply is badly needed. Inflation-adjusted construction spending fell 8.5% from June 2024 to June 2025 as high borrowing costs, expensive labor and materials and economic uncertainty constrained builder activity. The average cost to construct a new home rose to $260,229, excluding land, with major metros like Miami and San Francisco reporting even higher figures due to stricter codes and luxury-focused development. Still, some regions, including Delaware, New Jersey, Omaha and Richmond, stand out for delivering more affordable new housing. The uneven pace of construction underscores both the urgency and difficulty of addressing affordability, with lower-cost projects and efficient construction practices increasingly vital to expanding access to homeownership.