The Fed Cuts amid Partly Cloudy Conditions

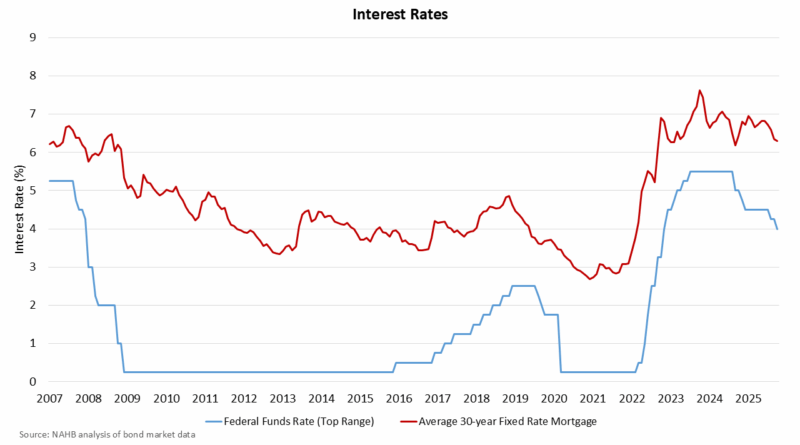

The Federal Reserve’s Federal Open Market Committee (FOMC) approved another 25-basis-point cut to the federal funds rate, lowering it to a range topping out at 4.0%. This marks the second consecutive reduction this fall, aimed at supporting a slowing job market amid limited economic data caused by the government shutdown. The decision, which markets had already anticipated, left long-term interest rates largely unchanged. However, it revealed sharp divisions within the Fed: new Governor Miran preferred a larger 50-point cut, while Kansas City Fed President Schmid opposed any reduction. Chair Jerome Powell acknowledged “strongly differing” views about whether to make additional cuts before year-end. The Fed’s statement described economic growth as moderate but noted that hiring has slowed while inflation remains stubbornly high.

The Fed also announced it will end its balance sheet reduction program, or quantitative tightening, on December 1, after shrinking its assets by $2.2 trillion. While it will continue allowing mortgage-backed securities to mature, the central bank plans to reinvest proceeds into Treasuries, a move that could stabilize overall holdings while gradually shifting toward shorter-term debt. Analysts say this mixed strategy could have uncertain effects on mortgage rates. For the housing sector, the rate cut should lower borrowing costs for acquisition, development and construction loans, potentially helping private builders expand housing supply. Looking ahead, policymakers remain cautious: weakening labor data could prompt further easing, but persistent inflation makes future cuts increasingly contentious. Powell emphasized that there is “no risk-free path” as the Fed navigates an economy sending mixed signals.